how are rsus taxed at ipo

5 Costly Mistakes To Avoid. In this article experts in stock comp financial planning explain five blunders and how to avoid them.

Restricted Stock Units Jane Financial

Determining the residential status of an individual in India is quite a tedious exercise.

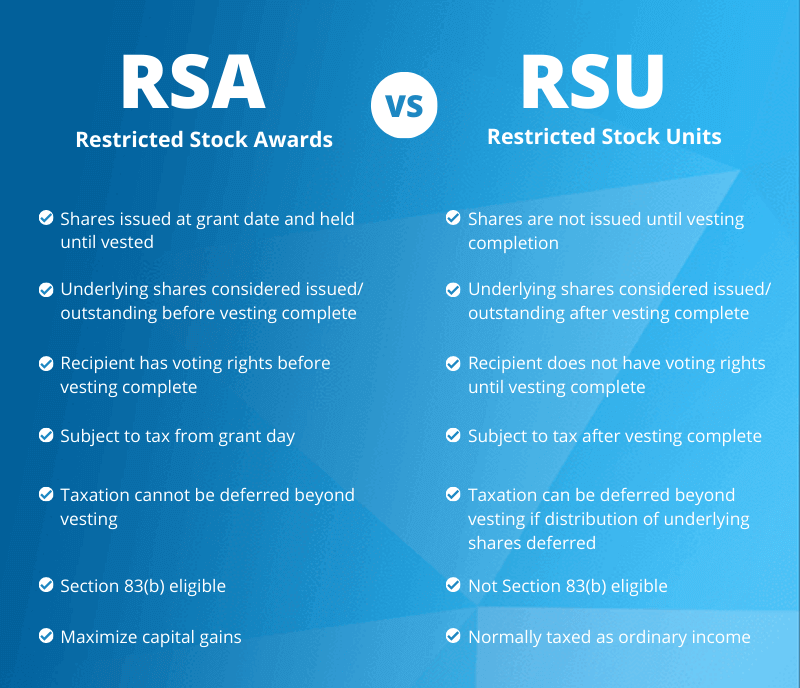

. An election pursuant to IRC 83b allows a recipient of restricted property to be taxed when the property is transferred instead of when the property actually vests at a later date when the value may be higher. Thats easier said than done however. RSUs often have multiple vesting conditions until the employee owns the shares outright.

With RSUs you are taxed when you receive the shares. The performancelinked award of six million shares to be executed through five tranches of 12-m shares till. The new ITR forms give a suitable description of different clauses due to which the residential status is determined.

The election must be made no later than 30 days from the date the property is transferred to the service provider with no. If it is deferred to 401k it is only taxed FICA and medicare. RSUs are taxable with taxes withheld similarly to wages as of the date the RSU vests and the actual stock is transferred to you.

Whether you work for a large established company or a startup on the verge of an IPO RSUs ISOs and the differences between them are imp. Once RSU is vested. Stock Options RSUs.

The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year. 45 - 30 15. If you lived outside India in the last Financial year Whether your income will be taxed in India or not depends upon your residential status.

However the units are taxed in the year that employees receive them even if the stock unit declines in value. Stock comp is complex. After your first year 25 of your NSO vest so you decide to exercise and sell all 1000 of your stock options.

Half goes into RSUs and half is under your control Each year we have the option to take stock award as stock have it paid out in cash or deferred to 401k. He would be taxed on the appreciation at the more favorable long-term capital gains rate instead of the higher ordinary income tax rate. If you have received restricted stock units RSUs congratulationsthis is a potentially valuable equity award that typically carries less risk than a stock option due to the lack of leverage.

If employees keep the restricted stock units for more than a year the RSUs are taxed at a lower rate as capital gains. Unvested RSU shares are forfeited back to the company immediately. 100 shares x 30 3000 taxed as ordinary income 2.

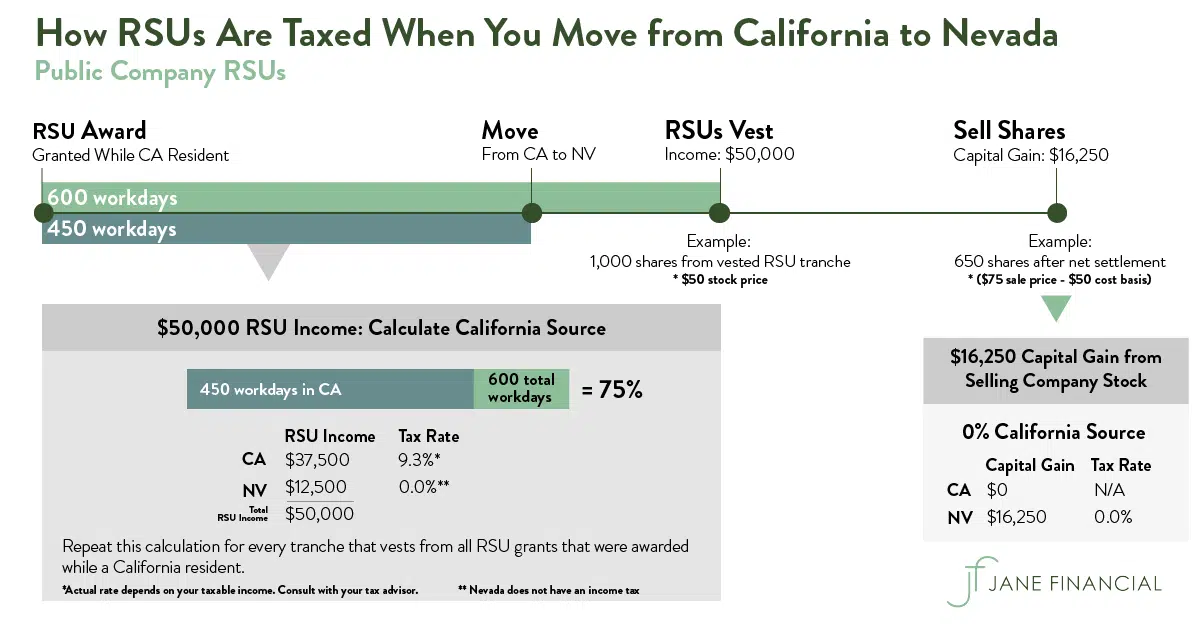

The special Section 83b election taxes employees before the RSUs vest. Many states tax RSUs if you live or work in the state during part of the vesting period even if you dont reside in that state when the award is taxed. The difference between the exercise price and the underlying stock price is taxed as ordinary income and generally reported on a Form W-2.

The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year. If the employee waits more than a year to sell the shares after the vesting date. 100 shares x 15 1500 taxed as capital gains.

Situation Tax Liability. If you move have your companys payroll department change tax withholding from one state to another. He could theoretically have saved a lot in taxes.

Unvested RSA shares are subject to repurchase upon termination. The participant generally will not be taxed upon the grant of a restricted share or performance share award but rather will recognize ordinary income in an amount equal to the fair market value of the Class A Shares at the time the Class A Shares are no longer subject to a substantial risk of forfeiture as defined in the Code. Its all too easy to make costly mistakes with stock options or restricted stockRSUs and the related taxes.

100 shares x 15 1500 taxed as capital gains. RSUs are taxed at vest time even if you hold the shares presumably because they can be sold immediately since they have some FMV. Tax apportionment is similar if you move between countries during the vesting period.

RSU and PSU grants are accounted for as equity-based compensation. Make no mistake about it. RSUs are not eligible for 83b elections and are taxed when they vest.

In addition the Company grants Class A restricted share units RSUs and performance-based RSUs PSUs to its employees and executive managing directors as a form of compensation. If the price the share is sold at is higher than the fair market value you will have to pay short-term capital gains tax on the difference. I think the parent poster is saying that this tax treatment of options is inconsistent with the way RSUs are taxed though.

The performancelinked award of six million shares to be executed through five tranches of 12-m shares till. The RSUs are taxed as extra compensation. Pay income tax on the shares.

Make the Most of Your Employers Initial Public Offering. 100 shares x 15 1500. Options are not taxed at vest time even if they are ITM and have some large positive FMV.

If it is taken as stock or cash it is taxed as ordinary income at marginal tax rates. If you sell them within a year of vesting. If you have NSO you get taxed on the day you exercise.

Your taxable income is the market value of the shares at vesting. 45 - 30 15. 100 shares x 30 3000 taxed as ordinary income.

We are granted stock each year. To know what you owe the state of California for this youve to know how many days you performed services in the state of California from the grant date to the exercise date. IPO may also require a.

RSAs are eligible for 83b elections. The Company has 473719 of treasury stock shares as of March 31 2022.

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsa Vs Rsu All You Need To Know Eqvista

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Financial Planning For Employees Before And After Ipo

Rsu Taxes Explained 4 Tax Strategies For 2022

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design