nassau county property tax rate

A year later it was 600000 a 143 percent increase. This website will show you how to file a property tax grievance for you home for FREE.

Property Taxes In Nassau County Suffolk County

My Nassau Information Lookup.

. What role does the annual assessment of my property play in determining my property taxes. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. What are the property taxes in Nassau County NY.

The median property tax on a 48790000 house is 512295 in the United States. The median property tax on a 21360000 house is 158064 in Nassau County The median property tax on a 21360000 house is 207192 in Florida The median property tax on a 21360000 house is 224280 in the United States. 20222023 Tentative Assessment.

Whereas the typical New Yorker pays 123 a year in property taxes Nassau County residents pay on average 179 or roughly 8711 a year. Nassau County Homeowners Are Grieving and Winning Reductions in Their Property Taxes New statistics released by the Nassau County Legislature report that some 219780 Nassau County homeowners filed property tax grievances during the current tax year. The median property tax on a 48790000 house is 873341 in Nassau County.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. The Nassau County Sales Tax. 109606 of these grievers about 50 percent received reductions on their property tax.

A flat fee of 090 will be charged for electronic check payments. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. What is the property tax rate in Nassau County.

So if your tax jurisdiction determines that the value of your property is 200000 and the tax rate is 2 your tax bill comes out to 4000. Across Nassau County residential property values increased by 119 percent in the same time period. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

You can also look up a specific property with an address search to get more details on its taxes. Nassau County 01933 New York 04610 National 03601 Running A Property Tax Search in Your Area. 240 Old Country Road 4 th Floor.

In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000. Payment by credit card will incur a convenience fee of 23 of your total tax payment. Enter your Address or SBL to get information on your.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. 518-266-1900 County Office Building. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

How much is property tax in Long Island NY. What is the Nassau County Property Tax Rate. You can pay in person at any of our locations.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. But not everyones situation is the same and tax rates can varysometimes greatlythroughout the County. What is the property tax rate in Nassau County NY.

Fernandina Beach FL 32034. Is my property assessment a tax. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes. Read on to learn more about the property tax rates in Nassau and Suffolk County. The median property tax on a 48790000 house is 600117 in New York.

Please note that a minimum convenience fee of 150 applies for credit card transactions. You may pay your current tax bill by credit card or electronic check online. Use the map below to quickly see tax rates in your area including what neighboring properties are paying.

Nassau County Tax Collector. Rensselaer County 1600 7th Avenue Troy NY 12180 County Clerk. Nassau County New York has a high property tax rate compared to the rest of the Empire State.

We offer this site as a free self help. Wont my property taxes go down if my assessment goes down. 240 Old Country Road 4 th Floor.

Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. In Nassau County the average tax rate is 224 according to SmartAsset. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

86130 License Road Suite 3. Download all New York sales tax rates by zip code. Learn all about Nassau County real estate tax.

Property Taxes In Nassau County Suffolk County

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

Looters Hit Stores In Emeryville Richmond San Lorenzo Police Say Same Group Targeted Oakland Night Before Home Realestate San Lorenzo Richmond Emeryville

Seven Tips For First Time Home Sellers Home Selling Tips Sell House Fast Sell Your House Fast

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Accounting Firms Accounting Services Tax Season

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

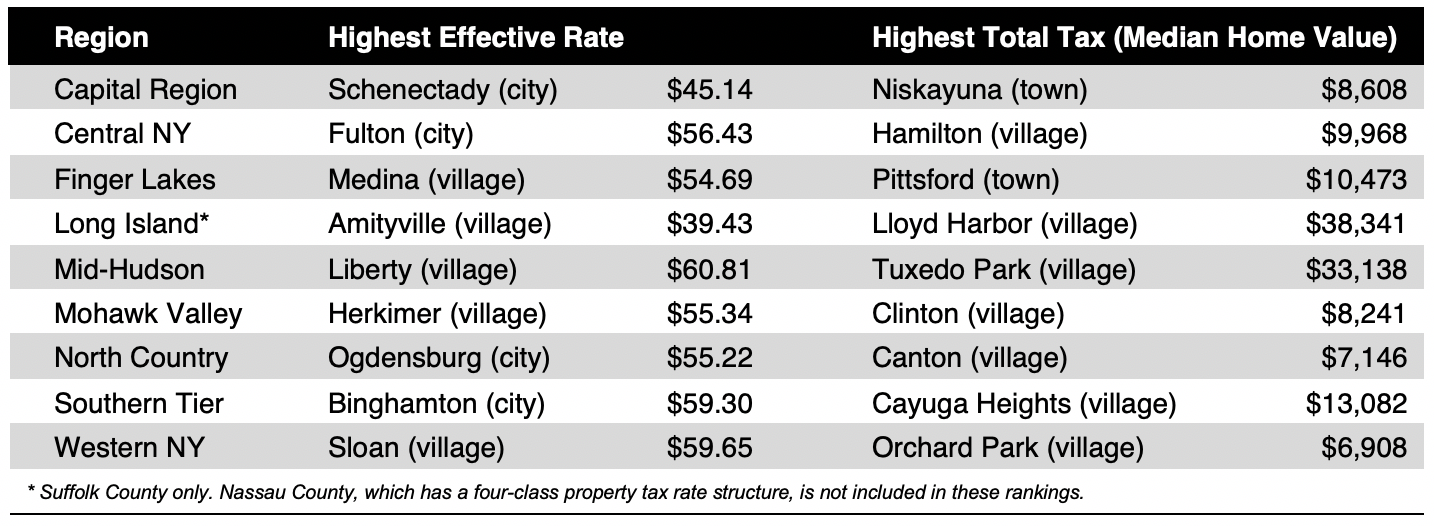

Compare Your Property Taxes Empire Center For Public Policy

Springfield Il Statue Of Abraham Lincoln Civil War Monuments Historical Events University Of Illinois Springfield

What Does As Is Mean For Buyers Realty Times In 2022 Types Of Loans Meant To Be Realty

Pin By Adelphi Career Center On Employer Partnerships Public School Employment Opportunities Private School

10 Steps To Mastering The Art Of Real Estate Referrals Referral Marketing Real Estate Marketing Strategy Real Estate Marketing

Top 10 Counties With Equity Rich Properties Equity San Mateo County County

Property Taxes In Nassau County Suffolk County

Your Local Real Estate Advisor Local Real Estate Real Estate Real Estate Agent

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Life Insurance Policy Review If You Wan T To Purchase Life Insurance Plan For Yourself And Wan T To Ge Investment Advice Life Insurance Policy Estate Planning